Money Scams and Strategies to Avoid Them

Fraud is a greater threat than ever with the rise of digital transactions and sophisticated scams. At Town & Country, we understand how critical it is to be vigilant, and we’re here to help with tips on how to identify and protect yourself from fraud.

Scams: Common Ploys for Your Pay

It’s best to stay in the know about the latest and most popular scams. One of the most prevalent forms of fraud today is check fraud, often combined with tactics designed to deceive victims into sending money or purchasing gift cards.

Unexpected Checks

A surprise check in the mail is a major red flag for fraud. Scrutinize any check you receive unexpectedly, especially from someone you don’t know well or at all. Scammers often send fake checks that may appear legitimate, but they bounce after they’re deposited.

Always contact the issuing party directly using contact information from an independent source (like the company’s official website) and not the details provided on the check itself.

Request to Send Back Funds

If you’re asked to send money back after receiving a check, do not withdraw funds or engage further until you can confirm the offer is valid. Scammers will send a fake check for a large amount of money, then ask you to wire a portion of the funds back to them for fees or as payment for services. Even if your bank deposits the check, it can still bounce, and you could be liable.

Gift Card Information

Scammers often ask victims to purchase gift cards and then provide them with the card information. Legitimate companies and government agencies never ask for payment in gift cards. Gift cards are difficult to trace and once the money is spent, it’s almost impossible to recover. For more information on gift card scams, consult the Federal Trade Commission (FTC).

False Lottery Winnings

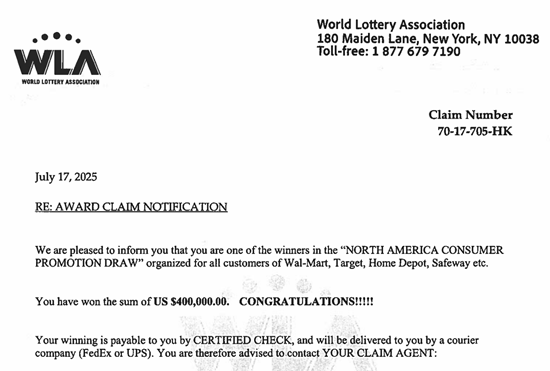

Another common con is fake lottery or sweepstake winnings. They tempt victims with a large sum of money they’ve won but requires a “processing fee” to release the funds. If you receive a letter or email claiming you’ve won a lottery you never entered, beware.

The World Lottery Scam (pictured below) has resurfaced again in Maine. If you receive this, hold onto the letter to report it to the FTC, and do not accept or deposit any funds sent to you.

Fake Technical Support Scams

Technology can be hard to keep up with, which is why technical support scams are so common. Scammers pretend to be from a well-known tech company, claiming your device or account has been compromised, then ask for your sensitive information and payment for their services. If you receive an unsolicited call or message claiming to be from tech support, hang up and contact the company through their verified customer support channels.

Schemes: Fraudsters’ Typical Tactics

Scammers are always evolving, but there are trends to their tricks. From phishing to FOMO (fear of missing out) these are the most popular tactics in fraudsters’ toolbelts.

Phishing Texts and Emails

Phishing attacks are designed to trick you into giving up personal information (account details, social security numbers, passwords, etc.). These messages appear to come from a trusted institution or service, but the link takes you to a fake website designed to steal your information. Always verify the sender of any suspicious messages before clicking on links or providing personal information.

Coaching Victims on What to Say

Scammers will coach victims on what to tell their financial institution if questioned about a transaction. If anyone advises you to lie or withhold information regarding a transaction, you’re likely dealing with a scam. Be transparent with your financial institution. Credit unions and banks are trained to recognize fraud, but they need accurate information to protect your account.

Pressure Tactics and False Urgency

Pressure tactics, like creating a sense of urgency to promote hasty decisions, are another fraudster favorite. They might threaten legal action or claim that an account has been compromised. Always take time to verify the details of any request for money or personal information by contacting the company or institution directly.

Strategies: How to Keep Your Money Safe

Scammers are very clever, so it is important to carefully review any offers you receive— whether they are via text, email, on the phone, or in the mail.

Fool’s Gold

Scams often come disguised as lucrative opportunities, like unexpected winnings, work-from-home offers, or unbelievable investment returns. Scammers prey on the desire for easy money, so be cautious of unsolicited offers and “golden opportunities.” Research the company or individual making the offer and consult a trusted advisor before proceeding.

Monitor Your Accounts Regularly

One of the best ways to protect finances is to watch your bank accounts and credit card statements carefully. Set up alerts on your accounts for any transactions above a certain amount or for any new activity. Look for unusual or unauthorized transactions and report them to your financial institution immediately.

Report Suspicious Activity Immediately

If you suspect you’ve been targeted by a fraud attempt or have fallen victim to one, report the incident as soon as possible. Contact your financial institution, file a report with the FTC, and consider placing a fraud alert on your credit report. The sooner you report potential fraud, the better your chances of preventing further losses.

Stay Vigilant —Fraud is Everywhere!

By staying informed and following these protective measures, you can reduce the risk of falling victim to fraud. Fraudsters are constantly evolving their tactics, but vigilance and awareness can go a long way in safeguarding your financial well-being.

If you suspect fraud in any of your accounts, Town & Country is here to help. Reach out to a credit union representative by emailing us at info@tcfcu.com, calling 800-649-3495 or book a consultation here.